Happy 5th Anniversary NEMO Health!

Where did time go? Companies acquire other firms every day, usually to get their hands on a technology, products, or a person. But against all odds, in 2013 three podiatrists decided to leave their lucrative practices to do what their profession called for. Now it’s their calling.

Sure acquisitions and mergers happen all the time. But some are real head scratchers and ultimately gambles that pay off. So on this 5 year anniversary of NEMO, I decided to study history for some of the most unlikely acquisitions imaginable. Here they are:

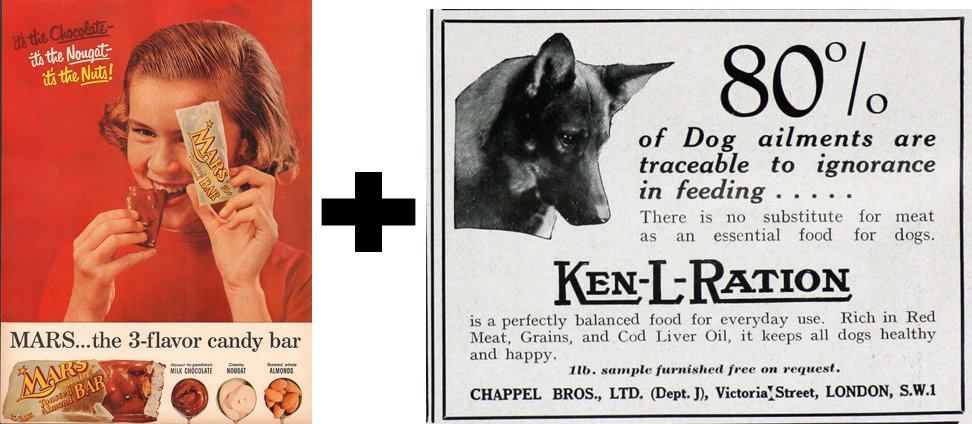

Mars and Chappell Brothers (1935)

In an early example of portfolio diversification, the candy maker acquired Chappell Brothers, which manufactured a canned dog food. Smart? You bt! Today, the majority of Mars’s business comes not from treats like M&M’s, but from pet brands such as Pedigree and Whiskas.

General Mills and Play-Doh (1965)

Seeing synergies between kid-focused foods and the toy market, General Mills snatched up Play-Doh maker Rainbow Crafts. That paved the way for its purchase of Kenner toys two years later. Smart? Of course! General Mills soon merged Rainbow and Kenner, and a bet on licensing Star Wars toys paid off big after the 1977 film blew up.

Getty Oil and ESPN (1979)

Getty Oil spent $10 million on an 85% stake in what was then known as the ESP Network, a little-watched 24-hour satellite sports channel. But Cable TV soon grew into a massive business, with ESPN as one of the medium’s major anchors, and ABC purchased the network in 1984 for around $200 million.

Turner and MGM (1986)

When cable mogul Ted Turner bought Metro-Goldwyn-Mayer, home of such classics as The Wizard of Oz, it was a shock to the media landscape. But Turner soon tapped MGM’s library when he launched the movie-oriented channels TCM and TNT, which helped expand his media empire.

Apple & P.A. Semi (2008)

Steve Jobs quietly paid a relatively small $278 million for a tiny maker of low-power chips. The move let Apple start designing the crucial components of its products rather than relying on Intel. Controlling its own chips proved to be a very successful strategy as Apple developed products such as the Apple Watch, iPhone 7, and AirPods.

So in retrospect, three podiatrists buying a podiatry specific electronic health record and medical billing company now doesn’t seem so farfetched. The past 5 years have been filled with some mistakes, learning curves, and many successes. We now celebrate our fifth year with the most up-to-date ONC certified technology.

Happy 5 year anniversary to NEMO Health and thank you to all of our growing family of colleagues!

The best is yet to come…